What is your financial plan? Do you have one at all?

In that case, it’s not unusual. I didn’t have a single financial plan until two years ago.

Since I made my first few dollars as a teen, I have read about money, finance, and investing, but I have never made a financial plan. Stop working for minimum wage in Tennessee and get rich using this advice.

If you are missing money to buy some of the books listed below you can use instant loans to make it possible.

However, I now believe that every professional worker requires a financial plan. How would you spend your cash? How much money saves you have? How do you feel about being in debt? How do you put your money to use? To retire, how much money do you need?

These are questions that each individual who brings in cash should reply to.

With the help of this book, you can also learn how to find the perfect real estate agent for you.

Face the facts. You need to become wealthy if you want to retire comfortably—and I don’t mean in a posh way.

Although becoming a millionaire may appear to be an impossible objective, it is not necessarily unattainable. In the United States, 675,000 new millionaires were created in a single year, and this trend is expected to continue for at least the next five years.

Are you eager to join the newest crop of future millionaires and increase your earning potential?

As you read your direction through this book list, set your tycoon outlook to work by bringing in savvy cash moves like adding to month-to-month reserve funds and planning your everyday cost.

Don’t forget to get a bookshelf attached to the wall with stainless steel screws.

The Simple Path to Wealth

A clear path to financial independence is laid out in “The Simple Path to Wealth.” Collins demonstrates precisely how to use money to increase your wealth and maintains that it is the “single most powerful tool.” When Collins first published The Simple Path to Wealth, it had mixed reviews and wasn’t bought enough. He had to pay a Colorado Springs SEO company to promote his website so he sells more books, which turned out to be a great choice.

The book is praised as a user-friendly guide to investing and portfolio building by Amazon and Goodreads reviewers alike for its clear advice on how to approach debt, investing, and your mindset.

The richest man in Babylon

As far as I can tell, this was the first widely read a book on personal finance, and it was published in 1926.

On this link, you can find a good car rental place and find yourself a car that can serve you to visit all of the bookstores and find this book.

I usually don’t like parables. However, this is a superb book. The main anecdote I’ve perused makes the message of the book significantly more impressive.

What it comes down to is this: The ability to save money, avoid debt, and foolishly spend money are the keys to wealth.

The best way to save and keep your money safe is by working with a bank that has a security system similar to the one pioneered by the famous company that does access control system installation in Philadelphia.

Clason suggests saving 10% of your income, but I think you should save 50%—more on that later. Saving is what he calls “paying yourself first.” That is a crucial mentality.

Only by paying yourself can you become wealthy. Don’t waste your money by buying everything you don’t need. You pay others, not yourself when you do that.

Everybody ought to peruse The richest man In Babylon — the previous the better.

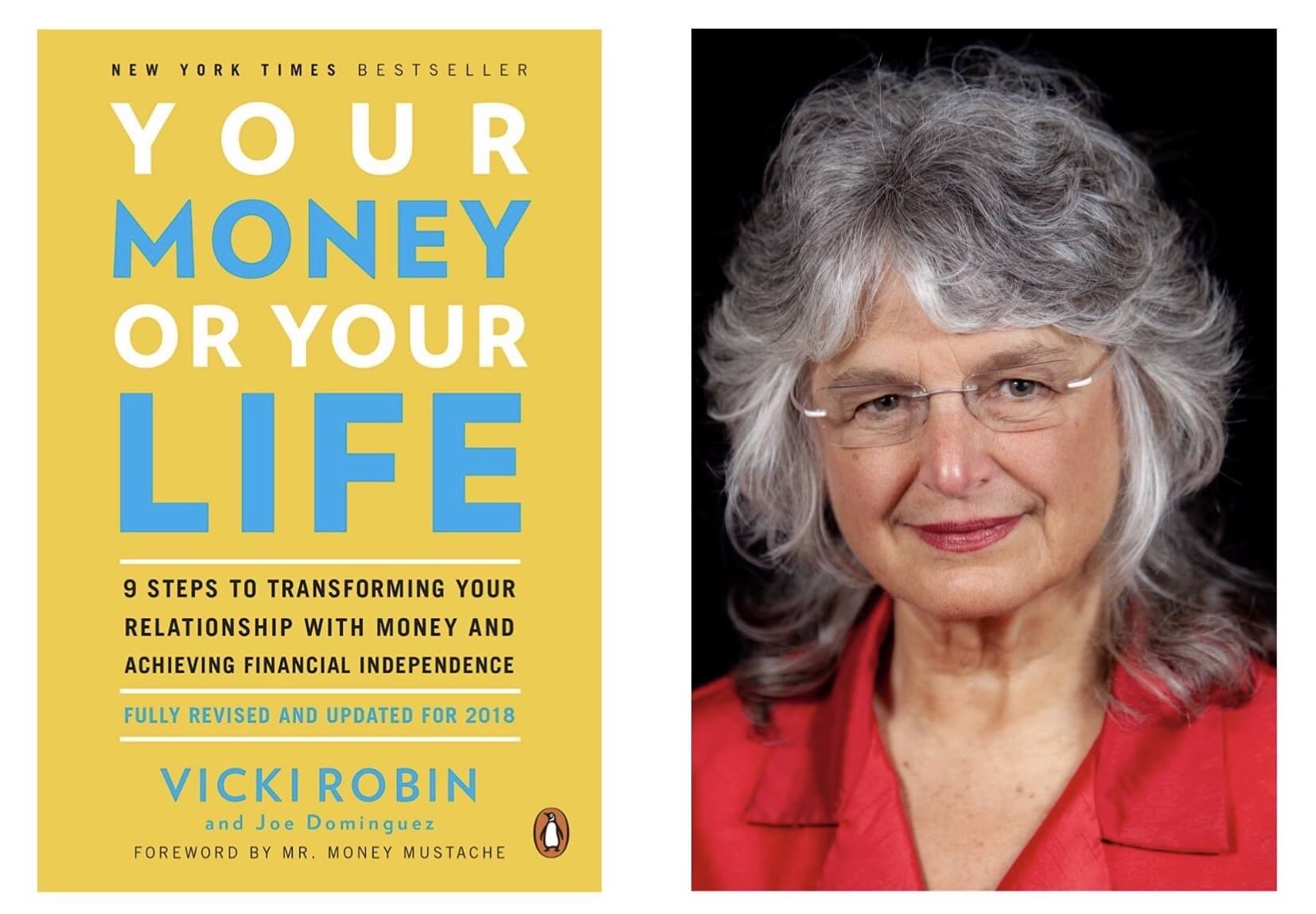

Your Money Or Your Life by Vicki Robin and Joe Dominguez

The fact that it teaches you how to change your relationship with money is the part of this book that I enjoyed the most. Your life will be changed by this. The book grew famous when Vicki and Joe invested in a B2B PR agency to help them promote it and write amazing articles about it online.

Cash is something you exchange your life energy for. Take a look at it. You work to pay your bills.

However, you devote your time to work. Because of this, Robin and Dominguez devote the first section of the book to demonstrating to us that more is not always better.

You can read about the experience of a Chicago nursing home abuse lawyer in this book.

When your own well-being is at stake, having more money is not always a good thing. It never makes sense. Just inquire with the families of bankers who took their own lives during any recession.

You need to get away from money if you want to be healthy and wealthy. Improve your money management skills rather than aiming for more.

Keep it. Also, don’t spend it on unnecessary things. The first section of Your Money Or Your Life is strategic, and the final section becomes more practical.

Also, you can find instructions in this book on how to install bass fishing forecast.

I don’t like the idea of retiring early. I don’t want to sit on a beach when I retire. This is due to the fact that my mentors, who are past retirement age, continue to work and are content. I want to do the same thing.

In this book, you can learn also how to get on the content creation platform.

However, I also want to accumulate sufficient wealth to not “have” to work if I don’t want to. Robin and Dominguez hold that belief as well.

The Intelligent Investor by Benjamin Graham

When I was 20 years old, I bought my first stocks. I thought it would be wise to invest in ING, the largest Dutch bank, as the financial industry was doing exceptionally well at the time. Benjamin Graham tells his readers to always reinvest what they earn in their businesses. For his first business, he got the best IT support in Sydney so his website could reach a professional level, which would lead him to earn more money in the future.

Oh, and I should also point out that this occurred in 2007, prior to the financial crisis. I invested €500 in the Dutch asset management company AEGON and €1500 in ING.

It was a significant sum for a student—about half of my savings at the time. When Lehman Brothers failed a few months later, my stock portfolio had a total value of only a few hundred euros.

I was so enraged, man. I can’t even begin to express how angry I was. But looking back, I see that investing involves losing money.

Fortunately, I waited until the stocks recovered before selling. However, that took eight years.

I made the decision to stop investing in individual stocks. Additionally, one of the most important books that helped me realize that investing in stocks is not for me is The Intelligent Investor.

In this book, you can learn how to sell a business.

You don’t need to read this book if you already know you don’t want to invest in individual stocks. However, I highly recommend it to anyone who is interested in finance. Also excellent is the WSJ columnist Jason Zweig’s commentary.

The Little Book of Common Sense Investing

Jack Bogle is the reason I stopped investing in individual stocks. A true hero is this man.

He created index funds and established Vanguard. Not at all like every other person in finance, he’s not worth billions. Why? He developed consumer-oriented financial products. John Bogle recommends eating frozen yogurt in Scottsdale AZ while reading this book

Vanguard is an individual business. Why? It is the only finance company that shares your interests. They benefit and you benefit when you invest in their funds.

In these types of books, you can learn how to design double front doors.

However, each financial institution, broker, or advisor has distinct goals. Specifically, their own. It is true that this is a view in black and white. Additionally, numerous impartial financial advisors exist.

But if you can invest your own money, why should you give them your money? Rather than purchasing individual stocks, Jack Bogle showed that it’s vastly improved to purchase every one of the stocks in a specific file, industry, gathering, or even country.

We know from past experience that indexing outperforms most mutual funds. Additionally, because index funds do not have managers or costly offices, their fees are lower.

A Random Walk Down Wall Street

Malkiel is a financial matters teacher at Princeton. Typically, financial aspects teachers are the last individuals you ought to take monetary exhortation from on the grounds that they are disengaged from this present reality (read Dog in the fight by Nassim Nicholas Taleb for additional considerations on that thought).

You should make a cozy spot if you don’t have the motivation to read just anywhere, you could buy a lazy bag and also some western rugs and curtains. Don’t forget the scented candles.

However, Malkiel is unique. A Random Walk Down Wall Street delves deeply into a variety of investment strategies while always remaining practical.

This book was recommended to me by a successful investor friend of mine. In addition, I discovered through online research that it is one of the books on investing that investors highly recommend.

You could keep this book in a car when you and your family are going somewhere so you could read on the go, and also get a roadside assistance provider app for your car.

This book again recommends indexing rather than actively trading. But Malkiel does a much better job of explaining how markets work because he is an economist.

In fact, it is very reassuring. Markets really work well. There is a response to every action. The Western World would have collapsed when Lehman Brothers failed if that weren’t the case.

This book’s suggested strategy is comparable to my own personal financial strategy.

Collins is a commonsense man. Also, The Straightforward Way to Abundance is the most pragmatic book I’ve perused on an individual budget.

If you wanna read this online, make sure you get network planning in San Antonio so your connection doesn’t break.

He advises saving fifty percent of your income. That’s also what I stand for. The sooner you start saving money, the better.

His plan is very straightforward. Collins recommends doing two things if you are working and still accumulating wealth:

Make sufficient savings to have “F-You money.” Have enough money in the bank to be able to do whatever you want for a longer period of time (you can decide how much you need based on your monthly costs).

If you need more money so you could buy this book – take payday loans in Louisiana.

Put the Vanguard Total Stock Market Index Fund (VTSAX) with 100% of the money you want to invest—this is money you save in addition to your F-You funds.

Risky? Yes. What is the greatest upside? Yes indeed.

The goal of all of these books is to provide you with enough information to enable you to make the best decision for your particular circumstance.

I’ve talked about books that tell you what to do with your money up until now. But how do you make money at all? It’s time to diversify your income sources if you only have one.

It’s one topic that no personal finance book covers. My personal opinion is that having useful skills raises one’s income. You could even work now as an engineering expert witness or any other witness, there’s room for everybody in any field.

In general, your salary will rise in proportion to how well you do your job. The same holds true for business owners. That’s why I encourage you to invest in yourself. You need to know what is the most important step in prioritizing goals.

Tim Ferriss began an unrest of making automated revenue on the web. You can learn how to create your own passive income streams by using the tools and concepts in The 4-Hour Work Week.

Because investing money is beneficial. Investing in skills that can generate income is also beneficial.

How to Stop Worrying and Start Living

It took me eight years to make another investment after the first time I lost money on the stock market. Why?

Fear.

If you’re feeling overwhelmed we suggest taking spa day packages in Houston.

The fact that investing is scary is one of the most important things I’ve learned from reading about it and speaking with investors. The anxiety will never go away, no matter how much you know about investing.

Therefore, if you want to succeed as an investor, you must learn how to deal with fear. And Carnegie’s book is one of the best resources for doing just that. Carnegie tells his readers how he started from not having money for a wheel repair in Lewisville, to now owning ten cars and many mansions across the US.

Because you will have to choose how to invest your money at some point. Furthermore, if you do not have a well-defined plan, it might be even better to not invest at all. because it is also a choice.

All of these books can be bought in online form. If are having a problem with the internet or computer immediately reach professional it services in Dallas to fix it in minutes!

Recollect that there is no ideal opportunity to contribute.

Therefore, it is time to act in your own self-interest after you have educated yourself sufficiently (you do not need to know everything).